By OPSWAT

At OPSWAT, our mission to protect the world’s critical infrastructure extends to more than securing the physical technologies that we rely on—we also protect individuals’ and organizations’ valuable data from breaches. As part of our continued commitment to data protection and privacy, we’ve put together a short list of technologies your organization can utilize to secure private data.

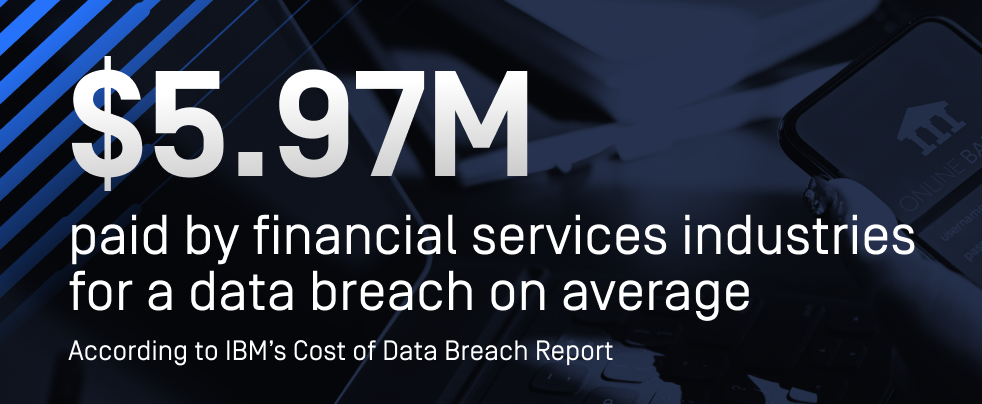

Protecting data from breaches is necessary for every organization, but it’s imperative for critical infrastructure, especially financial services. According to IBM’s Cost of Data Breach Report, on average, financial services industries paid USD 5.97 million for a data breach.

How to Support Data Privacy with Technology

With such a high penalty for failure, financial services must protect their customers’ valuable data, including personally identifiable information (PII), credit card numbers, and social security numbers from falling into the wrong hands.

Securing data is more than a compliance risk. It’s a reputational risk, with losses that extend past fines and remediation costs. A breach can take many forms, and financial institutions are vulnerable on multiple fronts, from malicious and negligent insiders to outsourced third parties and cybercriminals.

Financial services organizations are at risk without proper security practices, data management, and disposal plans, and need to utilize comprehensive privacy technologies to mitigate these risks.

Proven Privacy Technologies

Organizations can mitigate risks that arise from internal and external breaches by implementing a comprehensive set of technologies such as data loss prevention (DLP) and zero-trust endpoint protection.

Listed below are a set of technological recommendations for financial services firms to strengthen their data privacy defenses.

Proactively Prevent Data Loss with DLP Solutions

Automatically reduce the impact of data extraction by scanning all files for personal and sensitive data. Automatically redact sensitive information, watermark documents, and alert admins if private or sensitive information is sent through the network.

Manage Endpoint Solutions

Limit or stop breaches with endpoint security solutions for devices. Set rules for users to connect to your network including software and OS updates, access controls, and encryption.

Scan Files in Real Time for Malware and Alert When There’s a Problem

Use a platform that can identify known threats and block them immediately.

Implement Automated Compliance Controls

Identify sensitive data and meet industry standards such as Payment Card Industry Data Security Standards and the Gramm-Leach Bliley Act to ensure data protection.

Blend Your Zero-Trust Security Solution into your Daily Operations

As part of your operational model, assume all files contain private information and scan accordingly.

The cost of securing data pays dividends, and users respect organizations that value their privacy. Financial services firms must combine training, operational policies, and technologies to strengthen their data privacy posture.

Get in touch to learn how your organization can leverage OPSWAT technologies, such as Proactive DLP, multiscanning, and endpoint solutions, to help secure your organization and users against evolving privacy risks.

Discover how OPSWAT can help protect your private and personal information.

Tags: Data Loss Prevention, Multiscanning, CDR, Data Protection

If you are looking for CDR, Data Loss Prevention, Multiscanning, Emails security or other OPSWAT products in the middle east please contact us at +971 4 285 7366, [email protected]